Line 21 on your Form 1040 return may be confusing because it's somewhat of a catch-all line where different items are reported.

Gambling Winnings 1040 Line 21 1040

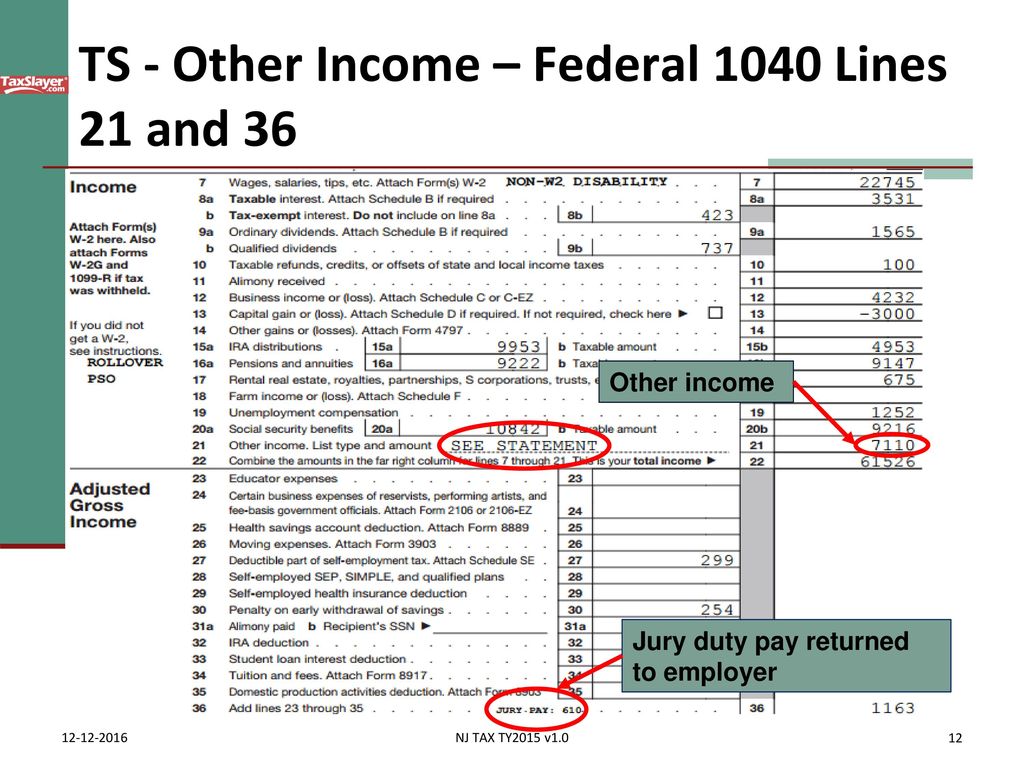

Basically, use line 21 to report taxable income not reported elsewhere on your return or on other schedules of your return. You should list the type and amount of income.

Other income is reported on line 8 of Schedule 1 of the 2020 Form 1040, then the total from line 9 of Schedule 1 is transferred to line 8 of the 1040 itself. These lines pertain to forms for the 2020 tax year, the return you'd file in 2021.

- I entered my 1099-MISC for prize winnings (a scientific award), but it shows up on the 1040 form line 21 as Gambling Winnings. How can this text be corrected? Delete the original entry. And make a line 21 entry this way. You can report it as other income on Form 1040 line 21.

- Regarding any lottery winnings, you are required to report the full amount of your gambling winnings for the year on Form 1040 and you do this on Line 21. The lottery payer may send you a W2-G Form that shows the amount of your gambling winnings and any tax that has been withheld.

- Gambling winnings; Re-employment trade adjustment assistance payments; Canceled debts; Taxable part of disaster relief payments; Net operating loss (NOL) deductions from prior years are also included on line 21. They should be shown in parentheses and serve as a reduction to the other income items listed on the return.

Some examples of the different types of income to report on line 21 follow:

Seneca Allegany Resort & Casino in Salamanca, NY has dining options from casual to elegant and for every taste. Make a reservation or stop by today! Feb 15, 2020 Good buffet that includes Good buffet that includes a little bit of everything, they have Asian, craving board with prime rib and turkey, pasta, pizza, salad. All for $21 if you are not a card member. Service was very good, waitress comes by to remove plates and refill. Seneca allegany casino buffet cost. Dec 17, 2019 Review of Seneca Allegany Resort & Casino. Reviewed December 17, 2019 via mobile. Visited on a Monday afternoon and evening. I read the buffet was buy one get one free for 55 and over. That was true and wow were they packed. For 20 dollars two can eat and drink. The buffet had everything imaginable. From shrimp to steak. We would like to show you a description here but the site won't allow us.

- Most prizes and awards

- Jury duty pay

- Alaska permanent fund dividends

- Recoveries

- Income from the rental of personal property but only if you are not in the business of renting such property

- Income from an activity not engaged in for profit

- Taxable distributions from a Coverdell education savings account or a qualified tuition program

- Taxable distributions from a health savings account or an Archer medical savings account

- Gambling winnings

- Re-employment trade adjustment assistance payments

- Canceled debts

- Taxable part of disaster relief payments

Net operating loss (NOL) deductions from prior years are also included on line 21. They should be shown in parentheses and serve as a reduction to the other income items listed on the return. In other words, NOLs are deducted from your current-year revenue sources.

Do not report any income from self-employment or fees received as a notary public on line 21. Those items go on Schedule C or F.

In addition, do not include any nontaxable income items on line 21. Some common examples would be:

- Child support

- Life insurance proceeds received because of someone's death

- Gifts and bequests

It's important to include all of your sources of income when gathering tax information for your tax professional each year.

Mardi Gras Casino & Resort implemented a comprehensive program ahead of its ahead of its June 5 reopening that features new health and safety standards aimed at helping keep guests and employees safe while slowing the spread of COVID-19 that include new entry procedures.

This article was originally posted on June 29, 2015 and the information may no longer be current. For questions, please contact GRF CPAs & Advisors at marketing@grfcpa.com.

Recently I was asked to review a return for a new client. He is a professional gambler and he wanted to make sure his previous tax preparer entered the information correctly. This gave me a perfect opportunity to present a case study to compare the differences between reporting as a person who gambles a few times a year with a person whose main activity during the year is gambling as a professional.

Non-Professional Vs Professional Gambler

Gambling Winnings 1040 Line 21 1040

Basically, use line 21 to report taxable income not reported elsewhere on your return or on other schedules of your return. You should list the type and amount of income.

Other income is reported on line 8 of Schedule 1 of the 2020 Form 1040, then the total from line 9 of Schedule 1 is transferred to line 8 of the 1040 itself. These lines pertain to forms for the 2020 tax year, the return you'd file in 2021.

- I entered my 1099-MISC for prize winnings (a scientific award), but it shows up on the 1040 form line 21 as Gambling Winnings. How can this text be corrected? Delete the original entry. And make a line 21 entry this way. You can report it as other income on Form 1040 line 21.

- Regarding any lottery winnings, you are required to report the full amount of your gambling winnings for the year on Form 1040 and you do this on Line 21. The lottery payer may send you a W2-G Form that shows the amount of your gambling winnings and any tax that has been withheld.

- Gambling winnings; Re-employment trade adjustment assistance payments; Canceled debts; Taxable part of disaster relief payments; Net operating loss (NOL) deductions from prior years are also included on line 21. They should be shown in parentheses and serve as a reduction to the other income items listed on the return.

Some examples of the different types of income to report on line 21 follow:

Seneca Allegany Resort & Casino in Salamanca, NY has dining options from casual to elegant and for every taste. Make a reservation or stop by today! Feb 15, 2020 Good buffet that includes Good buffet that includes a little bit of everything, they have Asian, craving board with prime rib and turkey, pasta, pizza, salad. All for $21 if you are not a card member. Service was very good, waitress comes by to remove plates and refill. Seneca allegany casino buffet cost. Dec 17, 2019 Review of Seneca Allegany Resort & Casino. Reviewed December 17, 2019 via mobile. Visited on a Monday afternoon and evening. I read the buffet was buy one get one free for 55 and over. That was true and wow were they packed. For 20 dollars two can eat and drink. The buffet had everything imaginable. From shrimp to steak. We would like to show you a description here but the site won't allow us.

- Most prizes and awards

- Jury duty pay

- Alaska permanent fund dividends

- Recoveries

- Income from the rental of personal property but only if you are not in the business of renting such property

- Income from an activity not engaged in for profit

- Taxable distributions from a Coverdell education savings account or a qualified tuition program

- Taxable distributions from a health savings account or an Archer medical savings account

- Gambling winnings

- Re-employment trade adjustment assistance payments

- Canceled debts

- Taxable part of disaster relief payments

Net operating loss (NOL) deductions from prior years are also included on line 21. They should be shown in parentheses and serve as a reduction to the other income items listed on the return. In other words, NOLs are deducted from your current-year revenue sources.

Do not report any income from self-employment or fees received as a notary public on line 21. Those items go on Schedule C or F.

In addition, do not include any nontaxable income items on line 21. Some common examples would be:

- Child support

- Life insurance proceeds received because of someone's death

- Gifts and bequests

It's important to include all of your sources of income when gathering tax information for your tax professional each year.

Mardi Gras Casino & Resort implemented a comprehensive program ahead of its ahead of its June 5 reopening that features new health and safety standards aimed at helping keep guests and employees safe while slowing the spread of COVID-19 that include new entry procedures. (WCHS/WVAH) NITRO, W.Va. (WCHS/WVAH) — Mardi Gras Casino and Resort has announced its reopening plan for Friday that focuses on helping to keep guests and employees safe during the coronavirus. NITRO, WV (WOWK) — Casinos across West Virginia are set to reopen Friday after being closed for months due to COVID-19. There are ropes in front of Mardi Gras Casino in Nitro, WV, to help keep visitors apart as they make their way back into the building for the first time in over two months. The casino is open at 9 a.m. Play at Cross Lanes's casino featuring slot machines, poker, greyhound racing & more. Then stay at the hotel to cap off your day of excitement. Mardi Gras Casino & Resort offers the best in gaming & accommodations in WV. Cash will once again begin flowing at the Mardi Gras Resort & Casino beginning June 5. The casino announced plans for reopening Friday under Gov. Jim Justice's recent directive.

This article was originally posted on June 29, 2015 and the information may no longer be current. For questions, please contact GRF CPAs & Advisors at marketing@grfcpa.com.

Recently I was asked to review a return for a new client. He is a professional gambler and he wanted to make sure his previous tax preparer entered the information correctly. This gave me a perfect opportunity to present a case study to compare the differences between reporting as a person who gambles a few times a year with a person whose main activity during the year is gambling as a professional.

Non-Professional Vs Professional Gambler

Gambling Winnings 1040 Line 21 Instructions

A non-professional gambler receives a W2G from the casino and the reported winnings will flow to Line 21 - Other Income on the Schedule 1 of the 1040. The amount of losses can be taken on the Schedule A Line 16. This deduction is limited to the amount of winnings. Also, the non-professional is not allowed to deduct travel, auto or other expenses related to the gambling activity.

The professional gambler also receives W2G forms, and in many cases, large numbers of W2Gs. When these are entered on the 1040, they are attached to the Schedule C for self employment. With the Schedule C, the taxpayer would be able to deduct resonable travel expenses, auto expenses and of course, the gambling losses - with the same deduction limitation. He would also be able to deduct his Self-Employment Heath Insurance and other deductions related to his business. Another benefit from the Schedule C is that the QBI could potentially give the taxpayer an additional 20% decution.

But there is a catch. The total amount of expense deduction on the Schedule C cannot exceed the total amount of winnings and must show that the majority of the income came from gambling.

Outcome of the Review

Gambling Winnings 1040 Line 21 Form

When I reviewed his return, I did find a few errors his previous tax preparer made. The taxpayer had almost 200 W2Gs. The tax preparer had mistakenly marked five of the W2Gs to flow to Line 21 - not the Schedule C. This caused the taxpayer to pay a substantial tax payment in error. I amended the return and my new client recently received his refund check from the IRS.